Poll tax

“Individual privacy has been cast aside as of no value and its loss—in addition to the poll tax itself—is a price that everybody will have to pay”

Harry Cohen, Labour MP, February 1989.

The Community Charge, better known as the Poll Tax, was introduced in Scotland in 1989 and then in England and Wales the following year. It was a system of local taxation and meant that each person was taxed the same fixed amount, set by their local authority.

The Community Charge, better known as the Poll Tax, was introduced in Scotland in 1989 and then in England and Wales the following year. It was a system of local taxation and meant that each person was taxed the same fixed amount, set by their local authority.

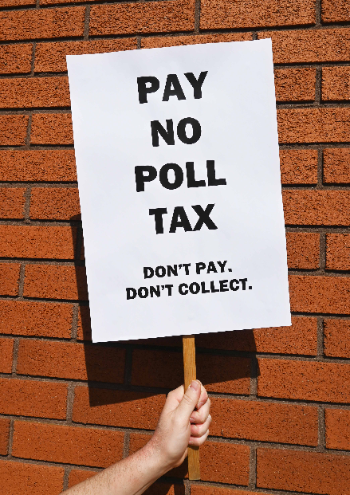

The protests and debates around the fairness of the charge are well-documented, but the policy was also criticised for its impact on privacy. Intended to make local council finance fairer, the tax triggered civil disobedience, riots and rebellion.

Harry Cohen spoke in Parliament on his suggested amendment to the bill. He highlighted that the government intended to spend “more than £100 million to…keep tabs on all adults” and that the legislation enabled poll tax officers “to know who lives and sleeps with whom so that they can collect the tax”.

Vehement national opposition to the poll tax ultimately led to its abolition. In 1991, Prime Minister John Major announced in a parliamentary speech that the poll tax was to be replaced by Council Tax, which came into effect in 1993 and is still in place today. This was based on the value of the property and considered far less intrusive.